This is a Revenue Framework Series from a Psychology standpoint which I intend to pen down for various companies. In case you want me to write about a particular company, please reach out; will try to pen it down on a go-forward basis.

Today’s company selection is Eicher Motors Ltd. While a rider of Royal Enfield needs no introduction about the company; however, for the benefit of all; the company is the global leader in the mid-sized motorcycle segment and is the owner of the iconic Royal Enfield brand motorcycles which has been in continuous production since 1901. The company also has a joint venture with Sweden’s AB Volvo, which is engaged in manufacturing commercial vehicles primarily – trucks and buses.

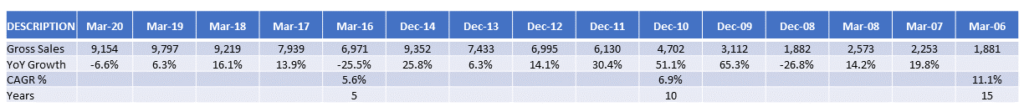

While the company’s revenue has grown at CAGR of 11.1% p.a. over the last 15 years; however, the pace of growth has been declining. Revenue CAGR growth for the last 10 and 5 years was 6.9% p.a. and 5.6% p.a. respectively.

It is important to understand the base year which is taken into consideration while calculating CAGR growth; lower value in the base year will show inflated growth rates, often coloring the mind with optimism, thereby making higher revenue projections in future. (Often used by Fund Managers to showcase their performance from 2008/09 – either in terms of actual performance or benchmark via their model portfolio – first being extremely unlikely considering it seemed that the world was coming to an end and the latter being like a big “IF”)

# Thus, Base Year Effect plays an extremely important role, especially in showcasing the performance and the growth rate; also one should not get overtly influenced by historical growth rate – the 2nd question which must be asked is “Since Which Year?”

# Another psychological tenet which needs to be mindful of is whether the company has Beginner’s Luck, i.e. initial good fortune. As Sherlock Holmes had said: “There are some trees, Watson, which grow to a certain height and then suddenly develop some unsightly eccentricity. You will see it often in humans and in companies” (added).

Thankfully, Eicher Motor has been producing motorcycles since 1901 – more than 100 years old; hence not just a wonder baby of just a couple of years. (Think of pager!!)

# Survivorship Bias occurs when we assume that success tells the entire story and that we do not consider past failures. But did you know that Eicher Motors until 2004 had 15 diverse businesses including tractors, components, footwear, motorcycles and garments. It was obviously struggling!! Its only when it divested all its businesses apart from motorcycles and formed a JV to manufacture commercial vehicles that the company started becoming focused and thereby becoming successful. (Eicher Motor’s Blockbuster Business Model)

From around INR 486 crores in market capitalization in 2004, the company’s market capitalization stands at INR 51,248 crores as Nov 6, 2020, CAGR of 31.5% p.a. in the last 17 years!! INR 1,00,000 invested in 2004 would have resulted in INR 1.05 crores, i.e. 105x of the money invested!!

Hence, the company’s revenue is not susceptible to Survivorship Bias, since it has been in operations for more than 100+ years and has been generating revenue since a long time.

# Inductive Reasoning arises on account of projecting from specific observations to broader generalizations and theories. Also, known as bottom-up approach, wherein someone begins with specific observations and measures, begin to detect patterns and regularities, formulate some tentative hypotheses, and finally ends up developing general conclusions or theories.

Considering that the company’s revenue is Recurring in nature and is NOT under Acquisitive mode, Eicher’s revenue projection will hopefully not be susceptible to Inductive Reasoning Bias.

Hopefully, when you look at Revenue of a company, some of the above psychological traits may enable you to fine tune your thoughts or projections!!

“Prediction is very difficult, especially about the future”

Niels Bohr

Disclaimer: Please note that these are my personal views. While, I am NOT a registered Research Analyst as per SEBI (Research Analyst) Regulations, 2014, all investors are advised to conduct their own independent research into individual stocks or industries before making any decision. In addition, investors are advised that past stock performance is not indicative of future price action.