While I was looking at the 3-wheeler industry in India in the last couple of days, one name which caught my attention was Atul Auto.

While the company originally originated as Atul Auto (Jamnagar) Pvt. Ltd. in 1986, the company now is one of the leading manufacturers of 3-wheeled Commercial Vehicles in the state of Gujarat. Having survived for 30+ years in a hyper-competitive environment and remaining profitable, without taking any debt is something which makes the company to have a worthwhile look. One needs to note that Bajaj Auto’s (3-wheeler industry’s largest player) volumes is 14.8x of what Atul Auto sold in FY2018. Yes, almost 15x!!! Despite this, it has not deterred Atul Auto from operating in a profitable manner.

One of the key reasons for this has been its ability to raise prices, without any loss in the volume of business – which makes it a great business.

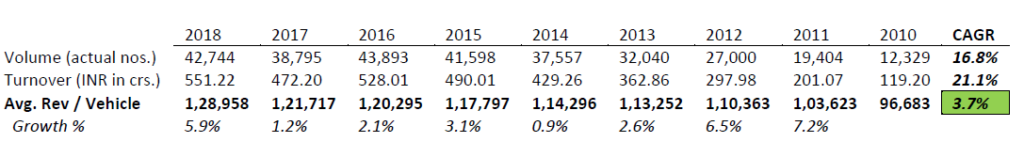

The company has maintained revenue CAGR growth of 16.8% since FY 2010 despite increasing the average price of its vehicle every single year since the same period. The company has been able to increase the price of its vehicles by 3.7% per annum since FY 2010, without any loss of volume.

While 2017 was one of the worst yearsin terms of volume, the only year since the last 9 years that the volume dipped(primarily on account of demonetization); despite such headwinds during thatyear, the company was still able to increase its average price by 1.2% over theprevious year.

Who says price increase necessarily leads to volume decline? At least in this case, this is not so!!!

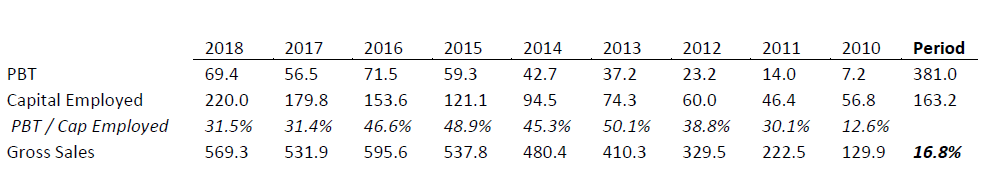

In 2010, Atul Auto’s sales was INR129.9 crs. and pre-tax earnings was INR 7.1 crs. The capital then employed bythe business was INR 56.8 crs. Consequently, the company was earning 12.6%pre-tax on invested capital.

In 2018, the company’s sales was INR 569.3crs. and pre-tax profits was INR 69.4 crs. The capital now required to run thebusiness is INR 220.0 crs. This means, that the company had to reinvest INR 163.2crs. (INR 220.0 crs. less INR 56.8 crs.)over the last 9 years to handle modest physical growth of 16.8% per annum andsomewhat immodest financial growth – of the business. In the mean-time, pre-tax earnings havetotalled INR 381.0 crs. during the last 9 years. The company earned 31.5% pre-tax on invested capital in 2018.

Typically, companies that increase their earnings from INR 7 crs. to INR 381 crs. would require anywhere between INR 1,870 crs. (considering 20% Return on capital employed) to INR 2,493 crs. (considering 15% Return on capital employed). That is because, growing businesses have both working capital needs that increase in proportion to sales growth and significant requirements for fixed asset investments.

However, Atul Auto has been different. It’s far better to have an ever-increasing stream of earnings with no major capital requirements.

One such investor, Mr. Vijay Kedia http://rakesh-jhunjhunwala.in/vijay-kedia-explains-how-he-made-5700-gain-from-atul-auto/ spotted this early on: He bought Atul Auto bucket full in 2005 and has made money compounded at least 31% CAGR over the corresponding period.

An investor who probably started looking at the company during 2010 would have compounded his return by a staggering 51% over the last 9 years. Obviously, these returns and insights look great in hind-sight, but there is no free lunch.

Patience + Hard work +Identifying and Betting (large) on the right business = Successful Investing

Disclaimer: Please note that these are my personal views. While, I am NOT a registered Research Analyst as per SEBI (Research Analyst) Regulations, 2014, all investors are advised to conduct their own independent research into individual stocks or industries before making any decision. In addition, investors are advised that past stock performance is not indicative of future price action.

Pingback: 2018: My Stock Performance Report Card – Jaagrav