Did you know: there were many attempts which were made by the aviators to fly initially using feathers and wings? People felt that since birds (having feathers and wings) can fly; if they also use the same parameters, even they would be able to take on air. Each of them was initially trying to correlate the parameters and form a hypothesis around flying.

This, however, did not result in much success until the Wright Brothers understood and executed the Causality mechanism, i.e. relationship between cause and effect – in principle, WHAT causes birds to fly and WHY? The breakthrough came about not crafting better wings or feathers, but studying and applying the principles of lift, thrust, drag and weight.

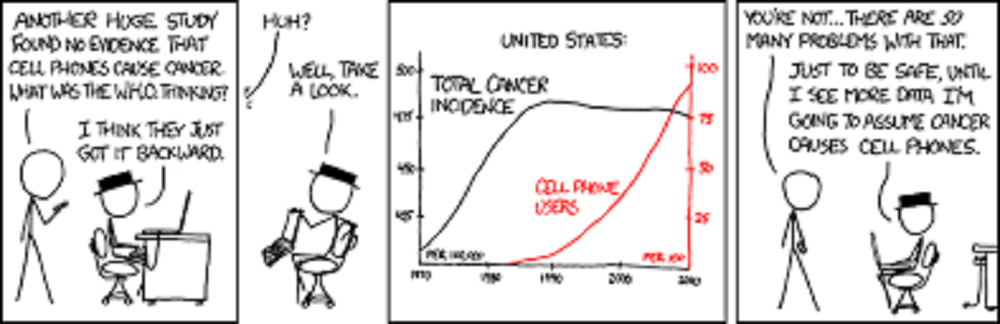

If you think the above example from an investing perspective, investors often commit investing blunders by seeking mere correlations:

- Return on stock market being positive in the election years (this is one correlation which is doing the rounds now)

- Great Market share means great company for investing (think about Jet Airways and Kingfisher Airlines during their heydays!!!)

- Greater beta means resulting in greater risk; Beta only signifies volatility in the price and not risk. In fact, when the stock price falls, it could be a great time to invest, fundamentals remaining intact though or a temporary problem which is solvable

- Order inflow to be positive for infra companies; how many infra companies with huge book orders have delivered, both fundamentally as well as from shareholder’s point of view?

One of the best ways to probe whether the correlation truly justifies causality is to look for anomalies – something that the correlation cannot explain.

Correlating birds, feathers and flight – Ostriches have wings and feathers, but can’t fly. Bats have wings but no feathers, and they are great fliers. And flying squirrels have neither feathers nor wings, but they get by.

Causality, i.e. relationship between cause and effect is where investors should focus their energies on:

- Return on stock market is a function of buying low and selling high!!! It’s that simple. The stock prices oscillate, however due to excessive greed and unwarranted pessimism.

- Great market share is a by-product of company’s revenue growth and industry’s growth. It’s a no brainer – revenue growth at the cost of profit is asinine and would lead to disastrous consequences.

- Beta has no correlation with returns on investment. In fact, with greater volatility (especially with stock price declining), chances of making money becomes higher. Don’t you want to buy a good thing cheaper? It is as simple as this!!

- Order inflow is like increasing numerator in a fraction. If the denominator increases more than the numerator, value of the number eventually decreases. With infrastructure companies, costs (denominator) due to incessant delays, increased leverage costs, fluctuating raw material prices, etc. kept moving up as compared to the order inflow; eventually leading to decline in the value.

Disclaimer: Please note that these are my personal views. While, I am NOT a registered Research Analyst as per SEBI (Research Analyst) Regulations, 2014, all investors are advised to conduct their own independent research into individual stocks or industries before making any decision. In addition, investors are advised that past stock performance is not indicative of future price action.

Superbly written !

Great examples Vikas! Very well articulated!!