3 Most Important Investing Lessons:

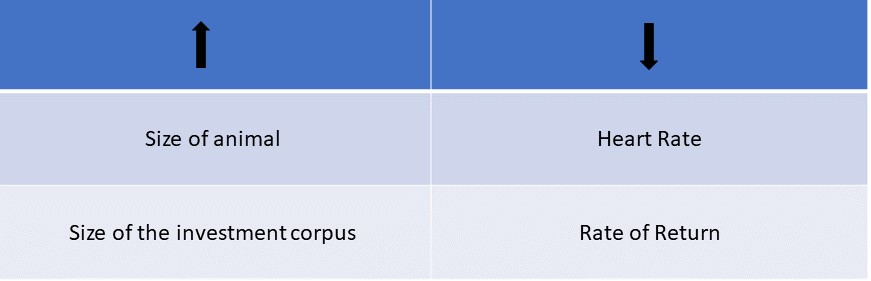

- As the size of the animal grows, its heart rate slows down. Kleiber, the biologist, discovered that metabolic rate of an animal scales to ¾ power of its mass. This scaling phenomenon resulted in “negative quarter-power scaling”, i.e. metabolism scales to mass to the negative quarter power.

The math is simple: you take square root of 1,000 which is approximately 31, and take the square root of 31, which is again approximately 5.5. This means that a cow, which is roughly 1,000 times heavier than a woodchuck, will on average, live 5.5 times longer, and have a heartbeat that is 5.5 times slower than the woodchuck’s.

Same is with investment corpus. As the size of your investment corpus increases, the rate of return usually starts to decline. This has been often cited by Warren Buffett, wherein he has clearly indicated that Berkshire Hathaway’s investment returns will not be the same as what it used to be historically. Investing billions of dollars enabling to generate consistent high returns on a go-forward basis would not be easy. This also helps to temper down the expectations of investors.

Have not really seen some of the largest fund managers stating this openly, obviously their bonuses are tied to the largeness of the AUMs being managed by them!! What a dichotomy!!

- While Charles Darwin was amazed at the millions of organisms which thronged the reef on his voyage – this is where the idea of Origin of Species originated. This also brings to light the strange paradox – on one hand, there was a reef just couple of miles from the mainland, which was teeming with millions of organisms; the mainland however, had few animals to boast of.

This is where Pareto’s principles of 20:80 or 10:90 (deeper concentration) also come in handy. While Introspecting one’s portfolio, you will often observe that most returns come from just a few stocks. This is what makes all the difference!!

More than 70% of the wealth of Rakesh Jhunjhunwala’s portfolio was because of Titan and Crisil.

- For an animal, a natural habitat provides it with environmental conditions to find and gather food, select a mate, and successfully reproduce. Similarly, for plants, a good habitat must provide them with optimal combination of light, air, water, and soil.

Just as natural habitat is important for the survival and development of plants and animals, similarly, good industry economics are important for the survival and the growth of companies.

If an industry is characterized by continuous low profit margins, high fixed costs, high intensity of competition and high bargaining power of buyers, the companies operating out of the industry will continue to remain paralyzed and running the treadmill, often, not being able to catch up – Think of industries like steel, auto ancillary, hospitality!!

Disclaimer: Please note that these are my personal views. While I am NOT a registered Research Analyst as per SEBI (Research Analyst) Regulations, 2014, all investors are advised to conduct their own independent research into individual stocks or industries before making any decision. In addition, investors are advised that past stock performance is not indicative of future price action.

and airlines. 🙂