If you look around, Barbie dolls which were priced low to begin with captured the heart of every girl when they were growing up. Gradually, as the girl became a mother, she ensured that her daughter got a better version of the doll with more frills and fancier clothes – she kept upgrading to a better version of the doll, thereby resulting in greater margins to Mattel on a go-forward basis!!

How is Maruti related to the above? Also, have you ever wondered, why does Maruti have 50% market share in the Indian passenger car market?

Sneak peek into the history of Maruti provides one startling insight. The company started selling its first vehicle, Maruti 800 in 1983 at a price of INR 48,000, less than half the cost of Ambassador (flagship product of Hindustan Motors) then.

This is where the company became successful because they laid the foundation of a Pyramid Business Model.

By pricing their car way below competition, it prevented Hindustan Motors from establishing a connection with its customers. (Hindustan Motors was one of the most credible passenger vehicle companies in India then, with a waiting time of 1 year for its popular, Ambassador (‘Ambi’) model.

Had Maruti sold their cars just around 5% to 10% cheaper than Hindustan Motor’s Ambi, the incumbent would have retorted likely by reducing its price, thereby resulting in price-war. While the customers would have gained, but Maruti would have been nipped in the bud and would not have been able to become one of the largest 4-wheeler passenger vehicle companies in the world today.

A true pyramid is a business model in which lower-priced products are manufactured and sold with so much efficiency that it is virtually impossible for a competitor to steal market share by under-pricing the product or the service; hence the lowest tier of the pyramid is known as the firewall.

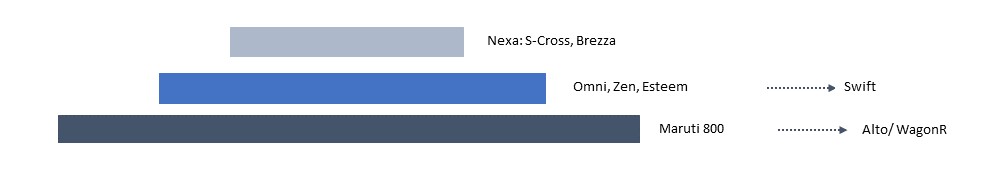

Maruti’s firewall tier was created by Maruti 800, which gave way to Alto and WagonR. This is where it kept building huge volumes, like Alto crossed 3 million mark in FY 2016. Net profit margins, however, remained at an average of 6% during this period.

With such thin margins, some of the other global automobile companies, including Toyota, Ford and GM couldn’t infiltrate the Maruti’s firewall tier, thereby enabling it to become mass market darling.

While, Maruti developed Omni, Zen, Esteem and later Swift as higher end-products, real break-through came when they launched their Nexa series through S-Cross in FY 2015 and later Brezza. This is where, volumes gave way to margins. Net profit margins doubled to approx. 10% in FY 2018 over the last 5 years.

While as a company, it followed a Pyramid business-model approach, wherein the lowest priced models enabled it garner 50% market share in the Indian market, the nature of customers also followed a pyramid structure too.

The customers too formed a hierarchy, with different expectations and different attitudes towards price. While there are customers who wouldn’t spend more than INR 2.5 lacs for an absolute basic version of Alto 800; there are others who have started to pay upwards of INR 10 lacs for the glitzy S-Cross via Maruti’s NEXA show-rooms.

Obviously, for this pyramid-business model to succeed, it needs to be executed mercilessly, which Maruti was able to do successfully over the years by creating the largest dealer network, launching successful models, and generating optimal financing options for its customers.

Disclaimer: Please note that these are my personal views. While I am NOT a registered Research Analyst as per SEBI (Research Analyst) Regulations, 2014. All investors are advised to conduct their own independent research into individual stocks or industries before making any decision. In addition, investors are advised that past stock performance is not indicative of future price action.

Nice article!! Thank you

Thanks Sachin!!

Very well articulated Vikas !

Thank you Chief!!!

Spot-On observations,Vikas.

Nice article…

Thanks Keshav!!

Vikas, very nicely articulated – Great job!!

Thanks Tarun for your feedback!!