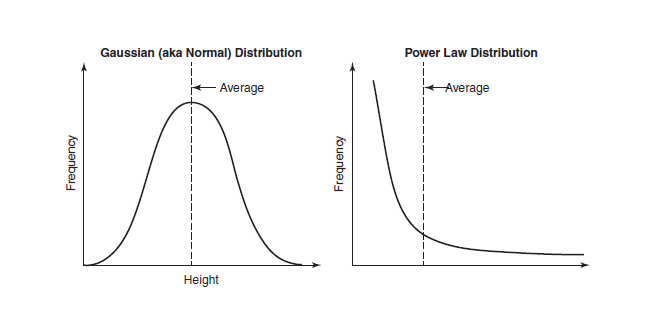

In a world described by the bell curve, most values are clustered around the middle. The average value is also the most common value. Outliers contribute very little statistically. If 100 random people gather in a room and the world’s tallest man walks in, the average height doesn’t change much.

But, if Jeff Bezos walks in, the average net worth rises dramatically. Height follows the bell curve in its distribution. Wealth does not. It follows a L-shaped distribution called Power Law, where most values are below average and a few far above. In the realm of Power Law, rare and extreme events dominate the action.

Investment or risk models based on the bell curve distribution, massively underestimate both the probability as well as the impact of outlier events. Next time, someone starts to give gyaan around Value at Risk (“VAR’) at certain confidence level thresholds, you may ask him:

Would you like to jump out of the plane with a parachute which opens 99% of the time? Risk management practices often assume that we live in a world best described by a bell curve where outliers are extremely rare, often resulting in management practices which were far riskier than was previously imagined.

Disclaimer: Please note that these are my personal views. While I am NOT a registered Research Analyst as per SEBI (Research Analyst) Regulations, 2014. All investors are advised to conduct their own independent research into individual stocks or industries before making any decision. In addition, investors are advised that past stock performance is not indicative of future price action.

Very interesting post, most people don’t understand the tail risk event, you not only have to survive the average bad but the absolute worst possible day. In investment parlance, you should have the ability to hold your investment through the worst possible drawdown not just survive the average bad period.