Hi,

This is Vikaas here, Investment Advisor and Founder of www.jaagrav.com. Today I am going to talk about how you as an investor should exercise the doctrine of caveat emptor, i.e. let the buyer be aware; while investing, even when the company is a MNC and sells quality products. After all, good quality products being sold by a company may not really translate to a good investment!! The company in question is Schneider Electric, the French MNC, providing energy and automation digital solutions across multiple industries.

How can the management’s remuneration keep growing at a CAGR 25% p.a. over the last 5 years when the company’s sales have de-grown by CAGR of 1% p.a. over the corresponding period? To add to further disappointment, the company has been incurring losses since FY2012. Cumulative losses for the company since the last 10 years has been INR 455 crs.

While the management has been silent about its performance mostly, only in FY2019 that it talked about building a healthy order book. However, the company’s order book did not translate into either profits or cash flows in that particular year or any of the earlier and subsequent years.

The company’s debt stands at INR 538 crs as on March 31, 2021, its going to be extremely difficult for the management to reduce the debt, considering the company has been incurring losses over the last couple of years, clearly indicative of lack of pricing power and intense competitive landscape.

Apart from debt, the company is also subject to number of significant tax litigations, thereby resulting in contingent liabilities, totalling to INR 332 crs as of March 31, 2021. Even a 20% adverse ruling on this can create a havoc on the already dilapidated balance sheet.

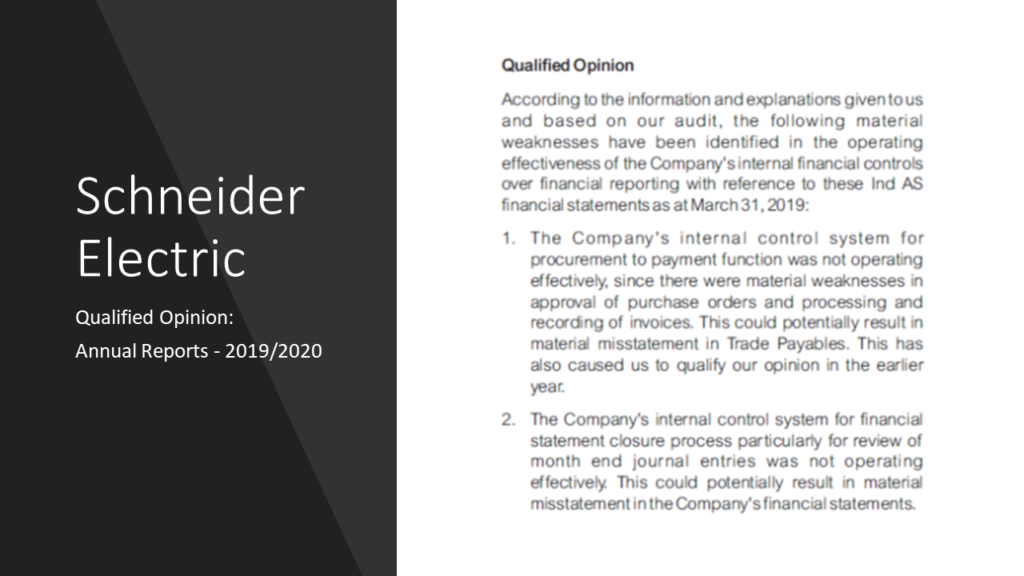

Auditor’s qualified opinion in FY 2019/20 does not bode well with respect to the company’s internal controls.

Reading out the Auditor’s Opinion verbatim:

Considering that the company has been incurring significant losses over the last couple of years, auditor’s opinion that the company’s carrying value of property, plant and equipment (PP&E) may be higher than their recoverable amount does not espouse confidence even on earning power of the assets.

Also, Management has not a good job of selecting its customers to begin with, since 20% of its debtors over the last couple of years have either turned bad or there is a provision which has been created for doubtful debts

Some Mutual funds, including government insurance companies have cumulatively more than 10% stake in the company. They may have some more insights which probably I am missing out. Well, I may surely end up buying some of my home protection instruments, switches and electrical sockets from Schneider but would definitely apply “Caveat Emptor” doctrine if I were to ever invest in this company.

Please note that these are my personal views. Request you to conduct your own independent research or consult your financial advisor before investing.

Hope you enjoyed listening to this!!

For more interesting topics, you may check out my website, www.jaagrav.com. If you want to reach out to me, you may email me at vikas@jaagrav.com

Thanks!