It’s not where are you today, but how have you grown over time is the key.

One of the key reasons for D-Mart (Avenue Supermarts) to be hugely successful is because of its presence and expansion strategy. In its annual report, 2017-18 the company spells out that they follow a cluster-based expansion approach, focusing on deepening their penetration in the areas where they are already present, before expanding to newer regions.

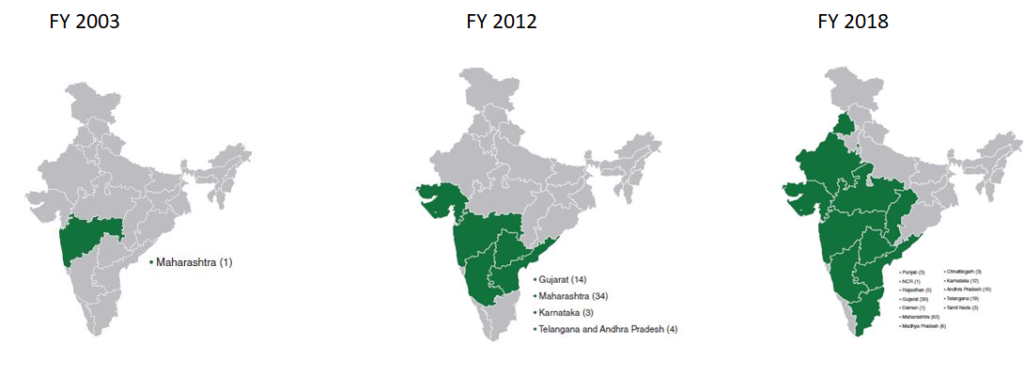

What started as 1 retail store in Maharashtra in FY 2002-03; at the end of 9 years, in FY 2011-12, DMart’s total retail count was 55, however it was restricted to primarily 2 states, viz. Maharashtra and Gujarat (both of them put together had 48 out of 55 stores). Fast forward, FY 2017-18, the total retail count is 155, however they are predominantly only in 4 states, viz. Maharashtra, Gujarat, AP/Telangana and Karnataka (133 stores out of 155 stores)

The below “Saturating the Circle” approach is the key determinant to the success of the company. Rather than sprinkling too thin across the country, it makes sense to build economies of scale from a regional perspective gradually and over time. Since retail is a low-margin high volume business, efficiencies around cost can only be built if one is able to saturate the circle over time.

In fact, DMart took 8 years to start its first 10 stores. This wasn’t because of dearth of investment opportunities, but more because Mr. Radhakishan Damani, the promoter’s belief in the importance of validating the business model from a perspective of both profitability and scalability.

While many retailers talk about scalability and about achieving national footprint, without any adherence or little adherence to profitability, with the assumption that over time they would be able to become profitable as well. However, they tend to get stuck in the middle, since they run out of financial fuel to support the expansion.

The recent fire sale of “More” supermarkets and hypermarkets covering about 2 mln square feet of retail space (pan India) Stores by Aditya Birla Retail Ltd. to a PE fund, Samara Capital and historically, Pantaloons sale to Aditya Birla Fashion Retail are testimonies to the importance of pattern of growth over just growth.

Disclaimer: Please note that these are my personal views. I am NOT a registered Research Analyst as per SEBI (Research Analyst) Regulations, 2014. All investors are advised to conduct their own independent research into individual stocks or industries before making any decision. In addition, investors are advised that past stock performance is not indicative of future price action.

Good work as always

Thanks for your kind words!

Good Thoughts !!

Pingback: 2018: My Stock Performance Report Card – Jaagrav

Pingback: IKEA – The Testament!!! – Jaagrav