If you recollect one of the advertisements by a leading automobile company couple of years back, when the sales presenter showcases physical attributes of a yatch to a prospective business tycoon, trying to impress him with its opulent features; he however is stumped when the billionaire (after the presenter’s gargantuan sales pitch) asks “Kitna Deti Hai?” In English, “What is its mileage?”

If you were to replace the above underlying question with “How much cash flow does one unit of capital produce?”, you would be able to identify great, good and gruesome businesses.

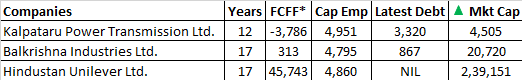

Let’s take three companies, each of which is reasonably well-known in their respective industries. Small snippet about each of them below:

Kalpataru Power Transmission Ltd. (KPTL) is amongst the largest players entrenched in the global power transmission and infrastructure EPC space and has established its presence in over 50 countries.

Balkrishna Industries Ltd. is one of the leading manufacturers in the Off-Highway tyre market and has a 6% market share globally. It sells its products in 130 countries through a network of national distributors.

Hindustan Unilever Ltd. (‘HUL’) is India’s largest FMCG company. With over 35 brands spanning 20 categories, the company is a subsidiary of Unilever, one of the world’s leading suppliers of Food, Home Care Personal care and Refreshment products.

Kalpataru: Having employed INR 4,951 crores over the last 12 years until March 31, 2018; the company however produced cumulative negative cash flows during the same period. Bulk of the capital which got employed to generate miniscule cash flows was financed by debt. Obviously, a pretty dangerous situation to be in. Shareholders increased their wealth by approximately INR 4,505 crores while the business employed INR 4,951 crores during the same period. Pretty gruesome business!!

Balkrishna: Having employed INR 4,795 crores over the last 17 years until March 31, 2018; the company produced cumulative free cash flows of INR 313 crores during the same period, employing very little debt. This came about having an average ROCE of 21% during the corresponding period. The shareholders increased their wealth by approximately INR 20,000 crores. Obviously, Good business to be in!!

The mileage (cash flows) produced by petrol (capital employed) was reasonable.

HUL: Having employed INR 4,860 crores over the last 17 years until March 31, 2018; the company produced cumulative free cash flows of INR 45,743 crores during the same period, employing NIL debt, which means every 1 unit of capital produced 9.4 units of cash flow. Who says, you can’t multiply!! Obviously, Great business to be in!!

The shareholder wealth increased by approximately INR 240,000 crores during the same period, employing the same amount of capital. Now, this is hell of a ride!!

No doubt, amongst all the three, HUL has been the most fuel efficient (Highest cash flow per unit of capital) and the safest (NIL Debt), thereby giving its passengers (shareholders) the most joyous ride (Highest Delta Market cap per unit of capital).

Disclaimer: Please note that these are my personal views. While, I am NOT a registered Research Analyst as per SEBI (Research Analyst) Regulations, 2014, all investors are advised to conduct their own independent research into individual stocks or industries before making any decision. In addition, investors are advised that past stock performance is not indicative of future price action.

Pingback: Revisiting 2018 – Jaagrav