One of the surest ways of making money in the stock-exchange is to befriend Mr. Market. While Mr. Market’s mood swings like a pendulum; wherein when he is very happy, he becomes greedy and throws a very high stock price on the market/stock-exchange. However, when he becomes sad, the pendulum swings on the other end and he comes fearful, wherein he starts throwing prices as if the world is coming to an end.

While the last 2 weeks has put Mr. Market in a fearful mood, wherein some stocks have eroded shareholders’ wealth by 50% in some cases. This, in turn, has led to many investors / speculators relooking at their existing stock portfolio or evaluating new positions (for obvious reasons).

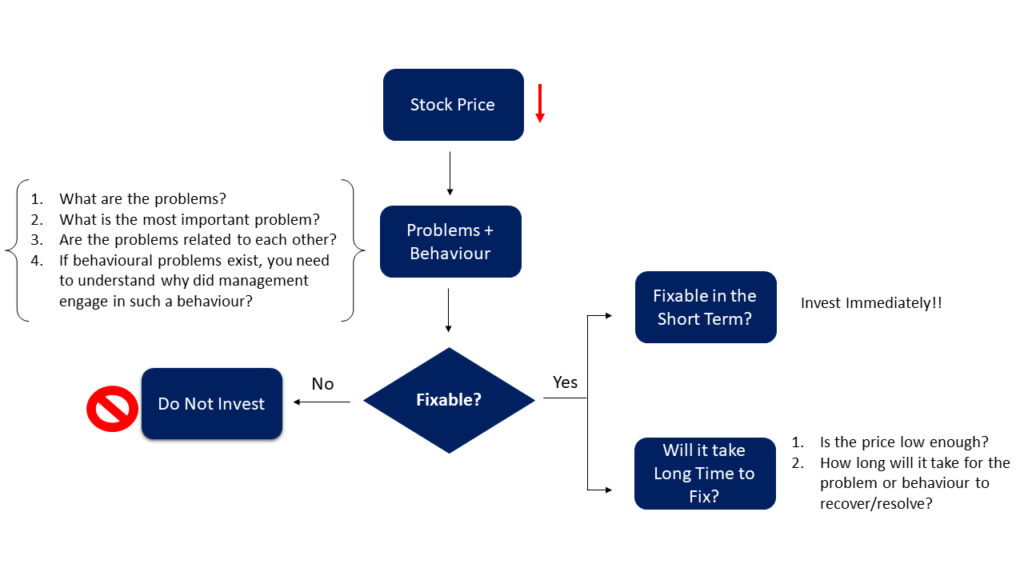

Below is a broad framework, which I have often used, thereby helping me to make investment decisions, especially when strong franchisees have lost market value because of some problems or some behavioral attribute.

For example: The Maggi fiasco, which plagued Nestle India in June 2015, wherein the company posted its first net loss in nearly 30 years of its existence in India, resulted in its stock price coming down from INR 6,830 per share pre-crisis to INR 5,540 per share in just 3 months (approximately 19% decline in the market price)

The below framework helped me answer some of the questions:

- What were the problems? Failure to take proactive measures despite having provided a formal notice by a food safety commissioner for not adhering to safety standards + Not recalling of the Maggi product, despite having provided warnings + Inappropriate and delayed Public relations, post the news breaking out

- What was the most important problem? Failure to meet specific food safety standards

- Are the problems related to each other? Steep fall in the company’s market share + Loss of mind-share / brand value among consumers + Loss of revenue and profitability

- Why did management engage in such a behavior? The management was over-confident of their claims that the products were safe; since they had never encountered anything like this in India, they took a little too lightly.

Obviously, the whole problem + behavior was fixable (this is better answered in hind-sight, of course!!!). Once one had made a judgement of the fixability of problems/behavior, one needs to take a call: how long would the problems persist and is the market price of the stock low-enough?

In Nestle’s case, since there was nothing which was inherently wrong, except the management’s lackadaisical attitude towards an incident of this nature, Mr. Market gave a thumps-up to the stock, obviously after long and grit work by the new management since several years now. The stock price today trades at INR 16,230 per share as on May 11, 2022 (~3x upside from its darkest days in June, 2015), thanks to the above framework and questions asked.

Disclaimer: Please note that these are my personal views. I am NOT a registered Research Analyst as per SEBI (Research Analyst) Regulations, 2014. All investors are advised to conduct their own independent research into individual stocks or industries before making any decision. In addition, investors are advised that past stock performance is not indicative of future price action.

Its a good rational way of analysing issues and avoiding noise while making a investment decsion.